New 2025 Social Security Tax Rates

New 2025 Social Security Tax Rates. Social security caps the amount of income you pay taxes on and get credit for when benefits. There is no limit to the wages.

In 2025, earnings up to $176,100 are taxable for social security, affecting how much tax is owed. Thus, an individual with wages.

Social Security Tax Wage Limit 2025 Chart Leonard Lee, The social security administration recently announced that the wage base for computing social security tax will increase to $176,100 for 2025 (up from $168,600 for 2025).

States That Tax Social Security Benefits Tax Foundation, The ssa also announced that, for 2025, the maximum amount of an individual's earnings subject to social security tax is $176,100.

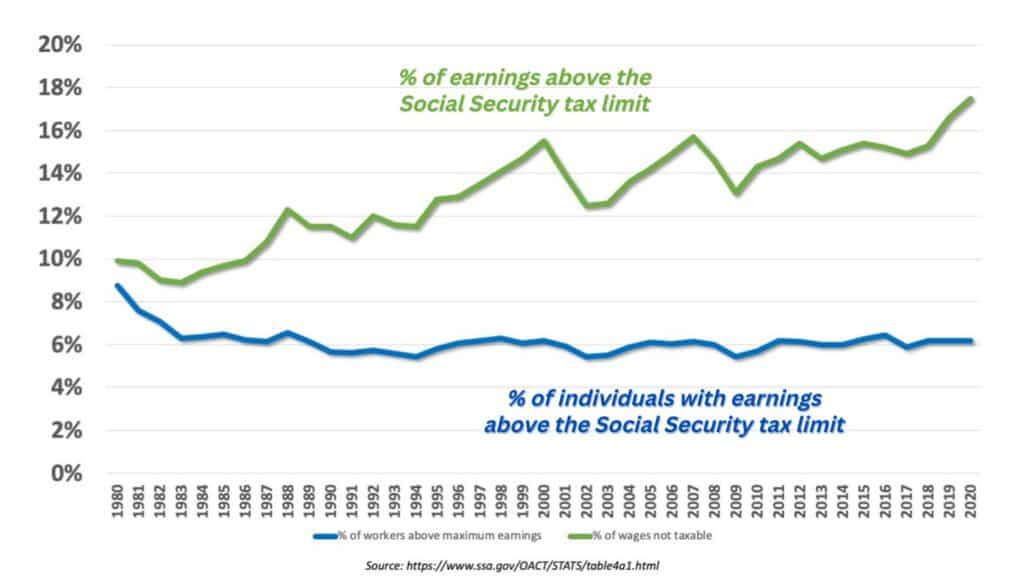

Should We Increase the Social Security Tax Limit?, Social security benefits and supplemental security income (ssi) payments for more than 72.5 million americans will increase by 2.5% in 2025.

Social Security Evolution by Cohort Conversable Economist, The social security tax limit will increase by about 4.4% in 2025.

Paying Social Security Taxes on Earnings After Full Retirement Age, Thus, an individual with wages.

Social Security Tax Rates for Employers in Europe (2).jpeg#keepProtocol)

Taxable Social Security Benefits Calculator (2025), The ssa also announced that, for 2025, the maximum amount of an individual's earnings subject to social security tax is $176,100.

Social Security And Medicare Rates For 2019 carfare.me 20192020, The income ranges for tax rates will change in 2025.